Uncertainty is inherent when investing, and that uncertainty is loudest in the short-term. It seems like there is always something to be afraid of, or a new opportunity to get in front of. Whatever it is, many investors try and act at the perfect time to either protect their portfolio against risks, or to get the biggest gain from investing early in an opportunity. Unfortunately, timing investments has shown to be just as much of a losing portfolio strategy as stock picking (remember, a diversified portfolio wins). Stay the course with respect to your financial plan and ride the ups and downs for a winning portfolio.

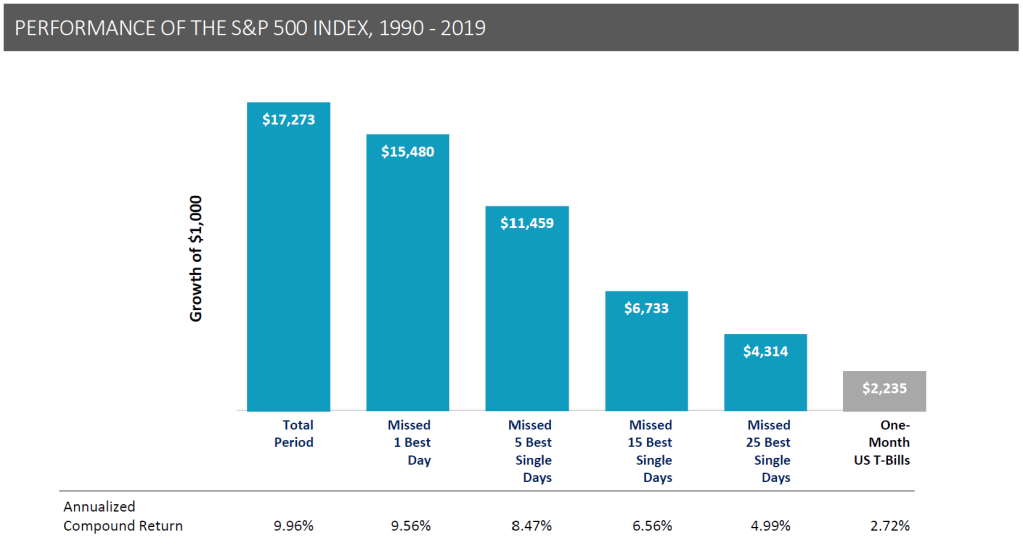

Here’s one of my favorite charts:

The data highlights that it can be very expensive to miss out on even one day out of 30 years of market returns. If you miss out on 30 of the biggest days (out of 30 years, not per year for 30 years), your portfolio ends up performing just better than inflation, while carrying equity-like risk. These 30 years include The Great Recession and The Dot-Com Bubble and the benchmark portfolio still returns exactly what we expect stocks to do over the long term (~10%), but that’s only if you had stayed the course during times of uncertainty. After a big drop in the market, a lot of people tend to get out of their investments and hold cash until the market recovers or stabilizes because they fear losing even more on their investments. By doing this, they risk losing out on the biggest earning days that make up a large portion of overall returns. It’ll take these investors more time to recover their earlier losses.

If market volatility makes you uneasy, that’s okay. That’s why great investors diversify their portfolio across multiple asset classes. For most of us, we can add bonds as ballast to the portfolio for a smoother investor experience. Control what you can control – it’s hard to control what the public stock and bond markets are going to do, but you can control how much you invest in either to have more control over the volatility your financial plan can handle. A lot of this has to do with the time horizon regarding your financial goals.

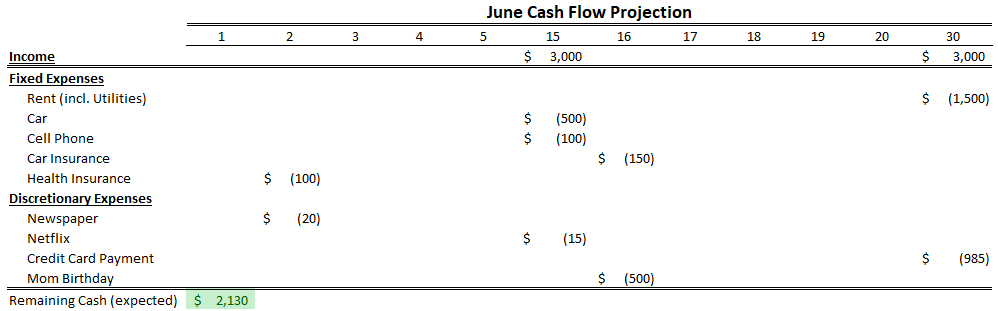

Here’s another chart I love.

Someone is always touting a reason for doomsday. Sure the markets certainly experience some volatility in the short term, but they’re usually wrong in the long-term and by trying to front-run the end of the world, you could have potentially lost out on one of the longest bull markets in American history.

I don’t know the future impact of Covid-19 on the stock market. I don’t know the effects of the upcoming 2020 Election (VOTE!). I don’t even know what else I need to be worried about to try and get ahead of. I do, however, know what kind of returns to expect in the markets over the long term to be a successful investor with regard to my financial plan. Stick to your allocation and control only what you can control.

Compliance stuffs

Just remember, I’m not your financial advisor so the information may or may not best apply to your situation and you should get formal advice prior to doing anything. The information/data that is shared should be double checked by you and any conclusion that is driven based on past data is not to be interpreted as my advice for your future. I will do my best to only write what I think is true and right, but mistakes happen and we’re all learning together – this is meant to be a conversation. My employer has nothing to do with this blog – in fact, they’re probably upset I’m writing here instead of working.